In the world of stock market analysis, the PE Ratio plays a crucial role in evaluating the valuation of a company. This article provides a comprehensive understanding of what is a good PE Ratio. Significance of PE ratio in stock market analysis, how to calculate it, and how to interpret it effectively. Let’s delve into the detail of the PE Ratio.

What is A PE Ratio?

The full form of PE Ratio is the Price-to-Earnings Ratio, it’s a financial metric used to assess the relative valuation of a company’s stock. It compares the relationship between the stock price and the earnings per share (EPS) of the company. The PE Ratio reflects the market’s perception of the company’s future growth prospects and profitability.

Importance of PE Ratio in Stock Market Analysis.

PE Ratio is a key tool for investors and analysts in evaluating stocks. It provides insights into the market’s expectations for a company’s earnings growth and profitability. PE Ratio helps identify undervalued or overvalued stocks and assists in making informed investment decisions.

PE Ratio Calculation.

The formula to calculate PE Ratio is straightforward. Divide the market price per share by the earnings per share (EPS) of the company. The result represents how many times the market is willing to pay for each rupee of earnings generated by the company.

High PE Ratio vs Low PE Ratio.

A high PE Ratio indicates that investors are willing to pay a premium for the company’s earnings, suggesting high growth expectations. Conversely, a low PE Ratio may indicate undervaluation or lower growth expectations.

Valuation PE Ratio.

PE Ratio is commonly used to compare the relative valuations of companies within the same industry. A higher PE Ratio suggests a higher valuation, while a lower PE Ratio may indicate an undervalued stock. However, it is important to consider other factors alongside PE Ratio for a comprehensive valuation analysis.

Factors Influencing PE Ratio.

Several factors influence PE Ratio, including industry dynamics, growth rates, earnings quality, market conditions, and investor sentiment. Different industries and sectors may have different average PE Ratios due to variations in growth potential, risk, and market expectations.

What Is A Good PE Ratio To Buy A Stock?

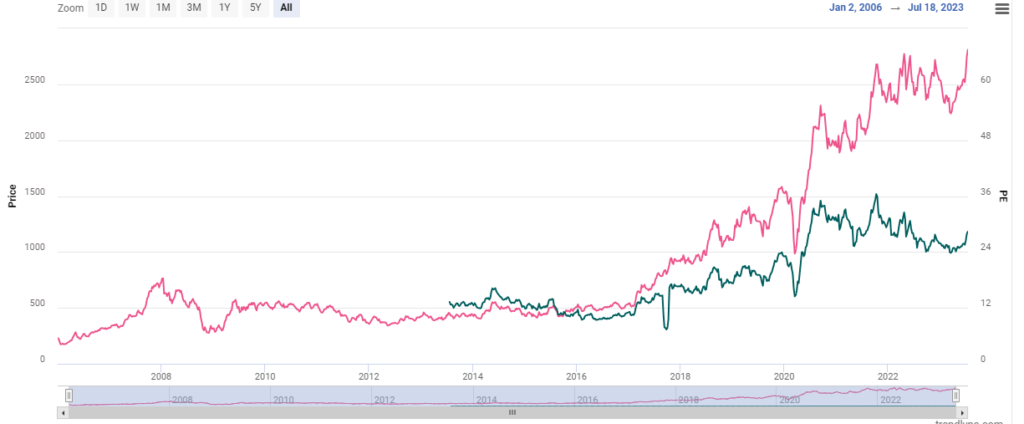

Determining what is considered a good PE ratio to buy a stock depends on various factors, including industry norms, growth prospects, and market conditions. While there is no universally defined “good” PE ratio, some investors consider a PE ratio within the range of 15 to 30-35 as potentially attractive for stock purchases, here is a good example of a stock price with a PE ratio within the range of 15 to 30-35.

In the above chart of Reliance Industries Ltd. Share Price with PE Ratio, we can see the PE ratio has maintained between 15 to 30-35 and the stock has shown growth in its price in the last 6 years.

Lower PE Ratio.

A lower PE ratio, such as below 15, may indicate that the stock is undervalued or has potential for growth. However, it’s important to consider other factors alongside the PE ratio, such as the company’s financial health, growth prospects, and industry dynamics.

Higher PE Ratio.

A PE ratio above 30-35 typically indicates that the stock may be considered relatively expensive or overvalued by some investors. However, it’s important to note that the interpretation of a PE ratio above 30-35 should not be solely based on this threshold. Points mentioned below also need to consider when evaluating a high PE ratio;

Compare Peers Stocks.

Compare the PE ratio of the stock you’re interested in with the average PE ratios of other stocks in the same sector. If the stock’s PE ratio is significantly lower than the sector average, it may indicate an undervalued stock.

Historical PE Ratio.

Evaluate the stock’s PE ratio relative to its historical PE ratios. If the current PE ratio is lower than the stock’s historical average, it might suggest that the stock is undervalued.

Growth Prospects.

Consider the company’s growth prospects and future earnings potential. If a company is expected to experience high growth in earnings, a higher PE ratio may be justified.

Market Conditions.

Consider the overall situation in the market and investor mood. During periods of market optimism, stocks may have higher PE ratios due to elevated investor expectations.

How To Predict Stock Based On The PE Ratio?

Predicting stock performance solely based on the PE ratio can be challenging because the PE ratio is just one metric among many that should be considered when analyzing a stock. While a low or high PE ratio can provide insights into valuation, it does not guarantee future stock price movements. However, the above points to consider when using the PE ratio as a factor in stock prediction.

Limitations of PE Ratio.

While PE Ratio is a valuable metric, it has certain limitations. It does not consider other important factors like debt, cash flow, or macroeconomic conditions. Additionally, PE Ratio can be influenced by one-time events, accounting practices, and market sentiment. It is crucial to use PE Ratio in conjunction with other financial metrics for a comprehensive analysis.

Conclusion.

PE Ratio serves as a fundamental tool in stock market analysis, providing valuable insights into the relative valuation of a company. By understanding how to calculate and interpret PE Ratio and considering its limitations, investors can make informed investment decisions. Incorporate PE Ratio into your analytical toolkit to enhance your understanding of stock market valuations.

The interpretation of a “good” PE ratio should not be solely based on a specific number. The PE ratio is just one tool among many used in stock analysis. Other fundamental and qualitative factors, such as financial health, management quality, industry trends, and competitive positioning, should also be considered.

It’s important to note that stock prediction is inherently uncertain, and no single metric can provide a definitive forecast. It’s advisable to conduct thorough research, analyze financial statements, consult with financial professionals, and diversify investments to manage risk effectively.

Frequently Asked Questions about PE Ratio In Stock Market.

What is a good PE Ratio?

There is no clearly defined what PE ratio is “good”, but investors consider a good PE ratio between the range of 15 to 30-35.

Good PE Ratio?

Investors consider a good PE ratio between the range of 15 to 30-35.

Ideal PE Ratio?

Investors consider an ideal PE ratio between the range of 15 to 30-35.

Is a high PE Ratio Good?

A high PE Ratio indicates that investors are willing to pay a premium for the company’s earnings. A high PE Ratio is not bad but it indicates that the stock may be considered relatively expensive or overvalued by some investors. Along with the high PE ratio the other factor also need to check such as the company’s financial health, growth prospects, and industry dynamics.

What is a High PE Ratio?

A PE ratio above 30-35 is considered as High PE Ratio and it typically indicates that the stock may be considered relatively expensive or overvalued by some investors.

What is a good PE Ratio to buy?

Investors consider a good PE ratio to buy is between the range of 15 to 30-35. However, there is a high potential too where the PE ratio is below 15, here other factors also need to check such as the company’s financial health, growth prospects, and industry dynamics.

What is a Low PE Ratio?

A lower PE ratio, such as below 15, may indicate that the stock is undervalued or has potential for growth. However, it’s important to consider other factors alongside the PE ratio, such as the company’s financial health, growth prospects, and industry dynamics.

Disclaimer: The information in this post and shown stock for example is just for entertainment, education, and information purpose and it does not indicate any kind of investment.