Vodafone Idea Limited FPO is open to suscribe from April 18, 2024 to April 22, 2024. Vodafone Idea Limited (VI) FPO is ₹10 to ₹11 per share. Vodafone Idea Limited (VI) is one of India’s leading telecom operators, is all set to launch its much-anticipated follow-on public offering (FPO) in the Indian Stock Market.

About Vodafone Idea Limited.

Vodafone Idea Limited (VI) is a joint venture between Aditya Birla Group (ABG) and Vodafone Plc. Established in 2018 through the merger of Vodafone India and Idea Cellular, VI has emerged as a strong competitor in the Indian telecommunications market. The company offers a wide range of mobile phone and internet telecommunications services to millions of subscribers across the country. It is an all-India integrated GSM operator offering 2G, 3G, 4G, LTE Advanced, VoLTE, and VoWiFi service.

Vodafone Idea Limited Business.

Vodafone Idea Limited busienss in telecommunications marke, provide a wide range of mobile phone and internet services to millions of subscribers across the country. Vodafone Idea Limited boasts a robust brand legacy spanning over three decades. In FY2023, its total income reached ₹424,885 million, with ₹321,256 million generated during the nine months leading up to December 31, 2023.

By December 31, 2023, the company had established approximately 183,400 tower locations across India, facilitating broadband services for over 438,900 units and extending coverage to more than a billion individuals. The merger notably enhanced their 4G population coverage, surpassing the 1 billion mark from 1.18 billion.

Vodafone Idea Limited FPO Overview.

Vodafone Idea Limited is set to launch its FPO. The Vodafone Idea Limited FPO opem on April 18, 2024 and close on April 22, 2024. The Vodafone Idea Limited FPO Price is set to ₹10 to ₹11 per share. The Vodafone Idea Limited will be listing in the stock market BSE, NSE on April 25, 2024. Vodafone Idea Limited is doing business in Indian telecommunications market and total income to December 31, 2023 was ₹321,256 million.

Also Read: Vodafone Idea to raise Rs 2,075 cr from Aditya Birla.

Purpose Of The Vodafone Idea Limited FPO Issue.

The Vodafone Idea Limited plans to use the money raised (net proceeds) for several key initiatives:

- Network expansion: This includes building new cell towers for 4G coverage (a), increasing capacity at existing and new 4G sites (b), and setting up infrastructure for the next generation of mobile data, 5G (c).

- Spectrum payments: The company will use some funds to settle outstanding payments for the Department of Telecommunications (DoT), including any Goods and Services Tax (GST) on those payments.

- General business needs: The remaining funds will be directed towards overall company operations and future endeavors.

Vodafone Idea Limited FPO Details.

| Face Value | ₹10 per share |

| Price Band | ₹10 to ₹11 per share |

| Lot Size | 1298 Shares |

| Total Issue Size | 16,363,636,363 equity shares, representing a total offering of ₹18,000 Crore. |

| Fresh Issue | 16,363,636,363 equity shares, representing a total offering of ₹18,000.00 Crore. |

| Issue Type | FPO |

| Listing At | BSE, NSE |

Vodafone Idea Limited FPO Schedule (Estimated).

| IPO Open Date | Thursday, April 18, 2024 |

| IPO Close Date | Monday, April 22, 2024 |

| Basis of Allotment | Tuesday, April 23, 2024 |

| Initiation of Refunds | Wednesday, April 24, 2024 |

| Credit of Shares to Demat | Wednesday, April 24, 2024 |

| Listing Date | Thursday, April 25, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on April 22, 2024 |

Vodafone Idea Limited FPO Lot Size, Minimum Investment & Maximum Investment.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1298 | ₹14,278 |

| Retail (Max) | 14 | 18172 | ₹199,892 |

Vodafone Idea Limited Board Of Directors.

| Ravinder Takkar | Non-Executive Chairman |

| Kumar Mangalam Birla | Non-Executive Director |

| Himanshu Kapania | Non-Executive Director |

| Sushil Agarwal | Non-Executive Director |

| Sateesh Kamath | Non-Executive Director |

| Sunil Sood | Non-Executive Director |

| Arun Kumar Adhikari | Independent Director |

| Anjani Kumar Agrawal | Independent Director |

| Ashwani Windlass | Independent Director |

| Krishnan Ramachandran | Independent Director |

| Neena Gupta | Independent Director |

| Suresh Vaswani | Independent Director |

The Management Team of Vodafone Idea Limited can be find here.

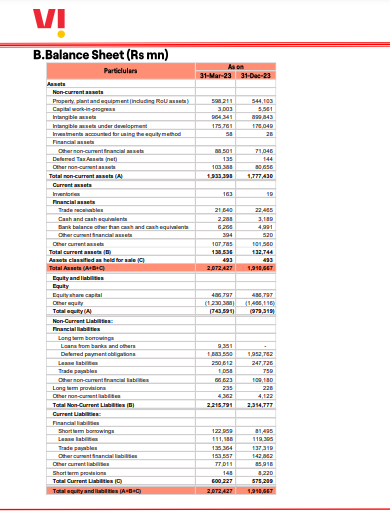

Vodafone Idea Limited Company Financial Status.

The complete Financial Report of Vodafone Idea Limited for current and past financial years is available on the company site, check here.

Vodafone Idea Limited FPO GMP Today | Vodafone Idea Limited FPO Grey Market Price.

Kindly be aware that the GMP prices displayed here are exclusively for informational purposes related to the grey market. We neither participate in nor endorse any transactions or dealings within the grey market, including its rates. Additionally, we do not advise or encourage investment in grey market trading.

| GMP Date | IPO Price | GMP | Estimated Listing Price | Last Updated |

|---|---|---|---|---|

| 17-04-2024 | 11.00 | ₹1.70 | ₹12.7 (15.45%) | 18-Apr-2024 0:27 |

| 16-04-2024 | 11.00 | ₹1.50 | ₹12.5 (13.64%) | 17-Apr-2024 0:23 |

| 15-04-2024 | 11.00 | ₹1.50 | ₹12.5 (13.64%) | 16-Apr-2024 0:30 |

| 14-04-2024 | 11.00 | ₹1.20 | ₹12.2 (10.91%) | 15-Apr-2024 0:30 |

| 13-04-2024 | 11.00 | ₹1.50 | ₹12.5 (13.64%) | 14-Apr-2024 0:27 |

| 12-04-2024 | 11.00 | ₹1.20 | ₹12.2 (10.91%) | 13-Apr-2024 0:30 |

Also Read: Swiggy Transition to Public Limited: Swiggy IPO Debut on Stock Market.

How To Buy Vodafone Idea Limited FPO?

Vodafone Idea Limited FPO applications can be submitted online with either UPI or ASBA as a payment method. The ASBA IPO application is available in your bank’s net banking. You can also apply for Vodafone Idea Limited FPO via UPI Payment directly from the broker platforms that offer IPO.

You can buy Vodafone Idea Limited FPO directly through broker platforms Zerodha, Upstox.

- Apply for C P S Shapers Limited IPO in Zerodha.

Create an Account & Apply for C P S Shapers Limited IPO In Zerodha.

- Apply for C P S Shapers Limited IPO in Upstox.

Create an Account & Apply for C P S Shapers Limited IPO In Upstox.

Vodafone Idea Limited FPO Frequently Asked Questions. People Also Ask for Vodafone Idea Limited FPO.

When Vodafone Idea Limited FPO will open?

Vodafone Idea Limited FPO will open on Thursday, March 14, 2024.

When Vodafone Idea Limited FPO will close?

Vodafone Idea Limited FPO will close on Monday, April 22, 2024.

What Is A Lot Size for Vodafone Idea Limited FPO?

The Lot Size for Vodafone Idea Limited FPO is 1298 Shares in 1 Lot.

What Is A Price for Vodafone Idea Limited FPO?

A Price for Vodafone Idea Limited FPO is set to ₹10 to ₹11 per share.

What is Vodafone Idea Limited FPO GMP today?

As on 17 April 2024, the Vodafone Idea Limited FPO gmp is ₹1.70.

What is Vodafone Idea Limited FPO Listing price?

As on 17 April 2024, the Vodafone Idea Limited FPO gmp is ₹1.70 with estimated listing price ₹12.7.

How To Apply For Vodafone Idea Limited FPO?

Vodafone Idea Limited FPO applications can be submitted online with either UPI or ASBA as a payment method. The ASBA IPO application is available in your bank’s net banking. You can also apply for Vodafone Idea Limited FPO via UPI Payment directly from the broker platforms that offer IPO.

You can buy Vodafone Idea Limited FPO directly through broker platforms Zerodha, Upstox.

Apply for C P S Shapers Limited IPO in Zerodha.

Create an Account & Apply for C P S Shapers Limited IPO In Zerodha.

Apply for C P S Shapers Limited IPO in Upstox.

Create an Account & Apply for C P S Shapers Limited IPO In Upstox.

The information provided in this article is for educational and informational purposes only. It should not be construed as investment advice or a recommendation to buy or sell any securities mentioned. Investing in the stock market involves risks, including the potential loss of principal. The information provided herein, sourced from various reputable sources, is believed to be accurate and reliable at the time of publication. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher of this article are not liable for any losses or damages arising from the use of the information provided herein.

If you have any objections or concerns regarding the content of this article, please feel free to contact us to address them appropriately.